Bitcoin Cash Flippening or Floppening

As of lately I’ve seen a huge spike in the Bitcoin cash price (which got a bit of interest).

Along with the spike, a lot of F.U.D has been spread on the bitcoin forums and reddit.

So what’s my opinion here about it?

The answer is no.

Here are my arguments against it

That “Fake Satoshi Guy” is supporting it

I don’t like that guy at all from what he presents himself.

He firstly approaches media outlets who aren’t tech savvy and convinces them that he is the bitcoin creator getting himself some undeserved fame, while the tech community questions him and asks him to prove himself.

However there is no proof provided, along with some bullshit post on why he can’t. Rigghhhhht.

ASICBoost patent controversy

ASICBoost belongs to a bitcoin miner manufacturer called BitMain.

The technology takes advantage of an exploit in pre-Segwit bitcoin (SegWit makes it stop working).

With ASICBoost, BitMain as a manufacturer and miner get to control the market. It makes commercial sense, however if you look at it from a legal perspective - it’s like the AntiTrust thing and Microsoft in the 90s.

See this Medium Article

The only feature right now is bigger blocks

While bigger blocks gives a reason for scalability, it’s something that can’t keep scaling forever as less people can run full nodes therefore making the network more centralized (and therefore censorship).

Fake news about the “Borgstream” conspiracy

There is some news going about all the bitcoin core (as in github.com/bitcoin/bitcoin) developers on the payroll. However, according to this site - less than half of the core developers are on the payroll.

Why would you spread fake news? I guess to discredit the competitor

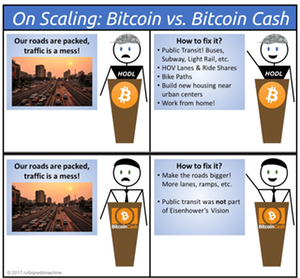

Scaling is only a short term solution

Basically the method of scaling for Bitcoin Cash is a short term fix.

Make more room in the blocks, but what happens when that gets full? Just increase it? But see the issue about centralization which is bad for a decentralized currency.

May as well just stick with non-blockchain currency.

Here’s an analogy: